Compare credit cards

Select cards to compare

You can choose up to 4 cards

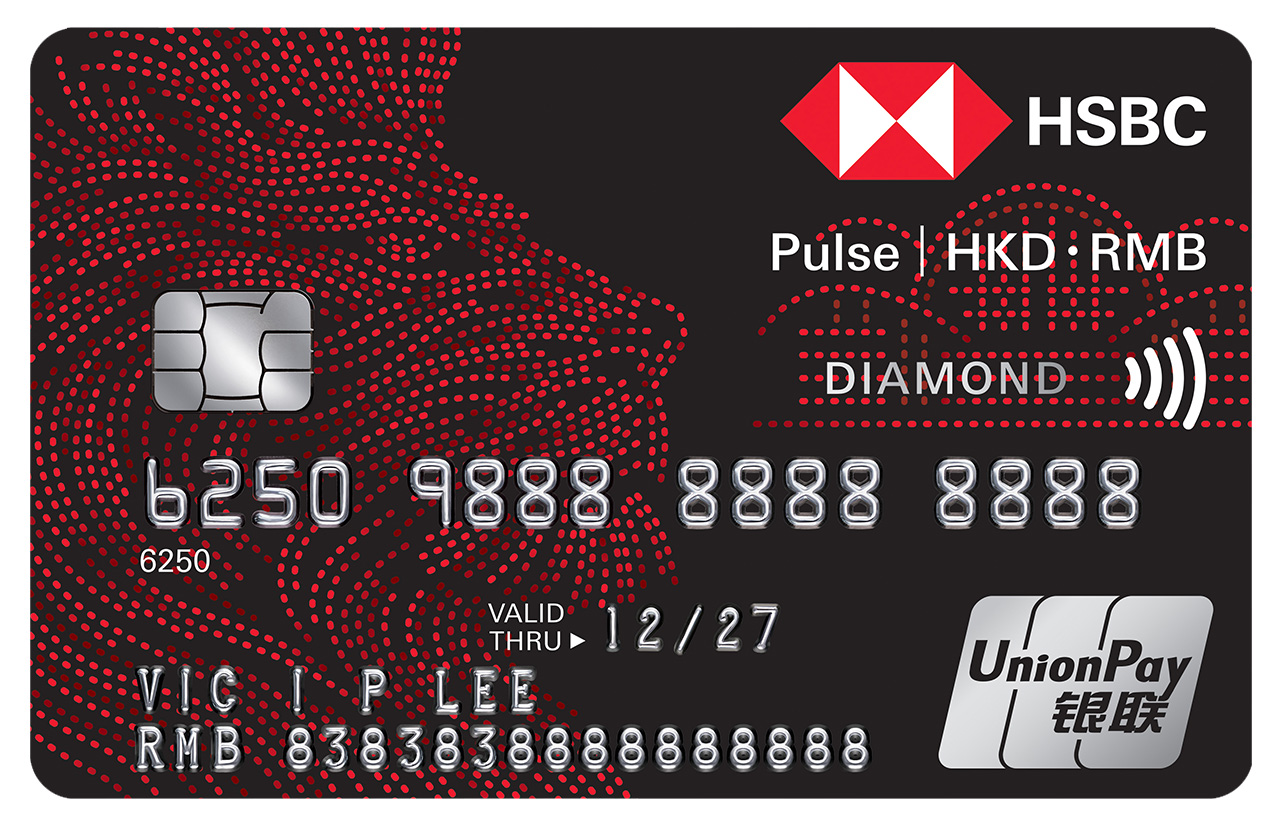

Manage your spending at home, in mainland China and beyond all on a single card.

Enjoy exclusive privileges worldwide and earn RewardCash every time you use your card.

Manage your spending with ease and enjoy fabulous rewards at home, in mainland China or beyond.

Exclusively for HSBC Premier banking customers. Delight in an array of extraordinary travel, dining and lifestyle privileges at home and abroad.

Add a touch of luxury to your life with extra rewards and superior dining privileges. Earn up to 3.6% RewardCash rebate in designated spending categories.

Spread your wings and experience true independence as you venture into adult life. Earn RewardCash when you pay your tuition fees and every time you spend on your card.

Level up your rewards. Earn up to 6X MoneyBack Points when you spend at PARKnSHOP, Watsons and Fortress, and enjoy shopping discounts on designated dates.

Red Alert! Red Credit Card has selected the hottest offers for you in town. Get up to 8% RewardCash rebate at designated merchants and up to 4% RewardCash rebate when you spend online.

Earn unlimited miles at a rate as low as HKD2 = 1 mile, and enjoy a wide range of complimentary travel perks.